All Categories

Featured

Table of Contents

We utilize data-driven techniques to review financial products and solutions - our evaluations and scores are not affected by advertisers. Unlimited financial has caught the passion of lots of in the personal finance world, assuring a course to economic flexibility and control.

Unlimited financial refers to a financial strategy where an individual becomes their own banker. The insurance policy holder can borrow versus this cash worth for different economic demands, successfully lending cash to themselves and paying back the policy on their very own terms.

This overfunding speeds up the growth of the policy's money value. Infinite banking offers lots of advantages.

Can I use Whole Life For Infinite Banking for my business finances?

Right here are the solution to some questions you might have. Is boundless banking reputable? Yes, limitless financial is a genuine approach. It involves utilizing a whole life insurance policy to produce a personal funding system. However, its efficiency relies on various aspects, consisting of the plan's structure, the insurance provider's efficiency and how well the method is handled.

Just how long does limitless financial take? Unlimited financial is a long-lasting approach. It can take numerous years, usually 5-10 years or even more, for the cash value of the policy to grow sufficiently to begin obtaining versus it efficiently. This timeline can differ relying on the plan's terms, the premiums paid and the insurance firm's efficiency.

How do I qualify for Infinite Banking Retirement Strategy?

So long as premiums are present, the insurance policy holder just calls the insurance policy firm and demands a finance versus their equity. The insurer on the phone won't ask what the loan will certainly be made use of for, what the earnings of the debtor (i.e. insurance holder) is, what other possessions the individual might need to serve as security, or in what timeframe the person plans to pay back the funding.

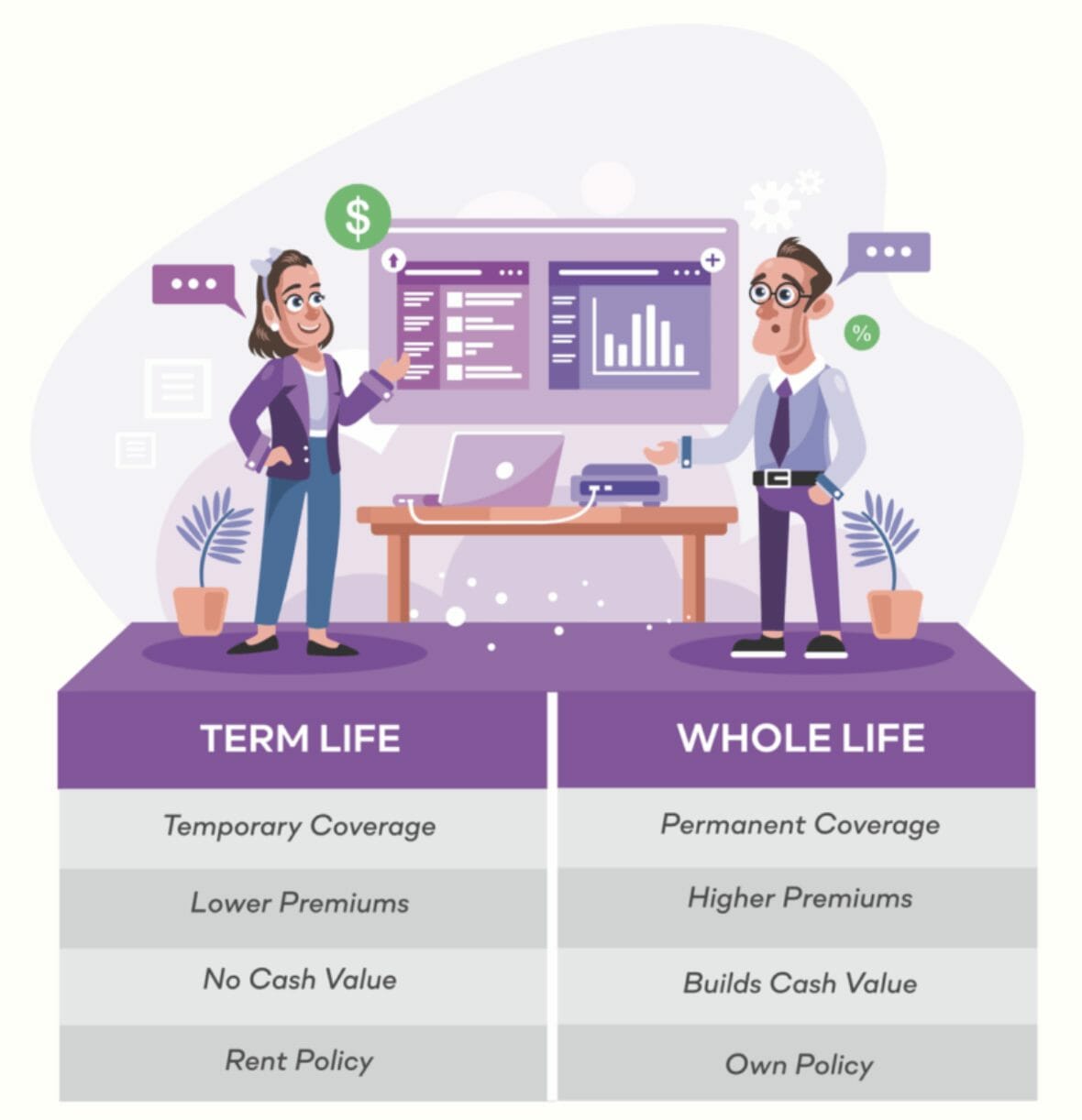

In contrast to call life insurance policy items, which cover only the beneficiaries of the insurance policy holder in the occasion of their fatality, whole life insurance policy covers an individual's entire life. When structured correctly, whole life plans generate an unique income stream that increases the equity in the plan over time. For additional reading on exactly how this jobs (and on the pros and cons of entire life vs.

In today's world, one driven by convenience of benefit, intake many as well lots of granted our given's purest founding principlesBeginning freedom and flexibility.

How does Wealth Management With Infinite Banking create financial independence?

Lower loan rate of interest over plan than the conventional car loan products get collateral from the wholesale insurance plan's money or surrender value. It is an idea that enables the insurance holder to take finances overall life insurance coverage policy. It ought to be readily available when there is a minute economic worry on the individual, in which such finances might assist them cover the financial tons.

Such abandonment worth works as cash money collateral for a funding. The policyholder requires to attach with the insurer to ask for a finance on the policy. A Whole Life insurance coverage plan can be described the insurance coverage item that gives defense or covers the person's life. In the event of the feasible death of the individual, it gives monetary safety to their family members.

It starts when a specific takes up a Whole Life insurance coverage plan. Such policies preserve their values because of their conventional method, and such policies never spend in market instruments. Infinite financial is a concept that permits the insurance policy holder to take up lendings on the entire life insurance coverage policy.

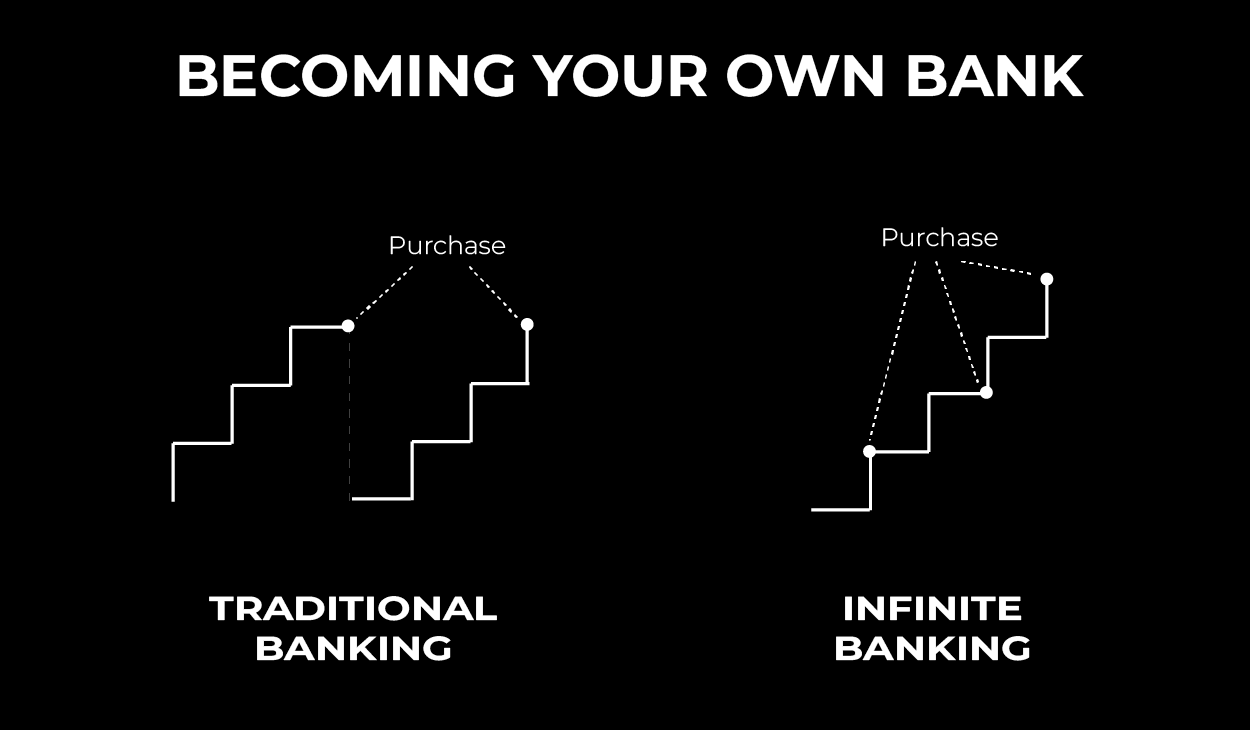

Infinite Banking Vs Traditional Banking

The cash or the surrender worth of the entire life insurance coverage works as security whenever taken lendings. Expect an individual enrolls for a Whole Life insurance policy plan with a premium-paying regard to 7 years and a plan period of 20 years. The individual took the policy when he was 34 years old.

The car loan rate of interest over the plan is fairly less than the traditional funding products. The security acquires from the wholesale insurance coverage plan's cash money or abandonment value. has its share of benefits and negative aspects in terms of its fundamentals, application, and performances. These aspects on either extreme of the spectrum of facts are reviewed below: Boundless banking as a financial innovation enhances capital or the liquidity account of the insurance policy holder.

Wealth Building With Infinite Banking

The insurance coverage plan funding can also be offered when the person is unemployed or facing wellness concerns. The Whole Life insurance coverage policy retains its total value, and its efficiency does not link with market efficiency.

In addition, one should take just such plans when one is monetarily well off and can take care of the policies costs. Boundless banking is not a fraud, however it is the best point most people can choose for to enhance their financial lives.

Is Borrowing Against Cash Value a better option than saving accounts?

When people have boundless financial discussed to them for the first time it looks like a wonderful and safe method to grow wealth - Infinite Banking benefits. The idea of changing the disliked financial institution with loaning from yourself makes a lot even more feeling. It does call for changing the "despised" financial institution for the "despised" insurance company.

Of program insurance coverage business and their agents enjoy the concept. They invented the sales pitch to sell even more entire life insurance coverage. However does the sales pitch measure up to real life experience? In this short article we will certainly first "do the mathematics" on infinite banking, the bank with yourself philosophy. Because fans of unlimited financial might claim I'm being biased, I will certainly use display shots from a proponent's video clip and connect the entire video clip at the end of this article.

There are no items to acquire and I will offer you absolutely nothing. You maintain all the cash! There are two major monetary disasters built right into the boundless banking idea. I will reveal these defects as we function via the math of exactly how unlimited financial actually works and how you can do better.

Latest Posts

Borrowing Against Whole Life Insurance

How To Set Up Infinite Banking

Life Insurance - Create Your Own Bank - Prevail