All Categories

Featured

Table of Contents

The method has its own advantages, yet it also has issues with high costs, complexity, and a lot more, leading to it being considered as a rip-off by some. Unlimited banking is not the very best plan if you require just the investment element. The boundless financial principle focuses on the use of entire life insurance policy plans as a financial device.

A PUAR allows you to "overfund" your insurance plan right approximately line of it ending up being a Changed Endowment Contract (MEC). When you utilize a PUAR, you rapidly raise your money worth (and your death benefit), therefore boosting the power of your "bank". Better, the more cash value you have, the better your interest and returns repayments from your insurance policy company will be.

With the surge of TikTok as an information-sharing platform, monetary recommendations and strategies have located a novel way of dispersing. One such strategy that has actually been making the rounds is the boundless banking idea, or IBC for short, garnering recommendations from stars like rap artist Waka Flocka Flame - Self-banking system. While the method is currently popular, its origins map back to the 1980s when financial expert Nelson Nash presented it to the world.

Can Infinite Wealth Strategy protect me in an economic downturn?

Within these policies, the cash worth grows based on a rate established by the insurance provider. When a significant cash worth accumulates, policyholders can acquire a cash money value finance. These lendings differ from traditional ones, with life insurance policy acting as security, meaning one can shed their protection if loaning excessively without appropriate cash worth to sustain the insurance expenses.

And while the allure of these policies is obvious, there are innate constraints and threats, requiring thorough cash money worth monitoring. The strategy's authenticity isn't black and white. For high-net-worth people or company owner, especially those utilizing techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance development could be appealing.

The attraction of boundless banking does not negate its obstacles: Cost: The fundamental requirement, an irreversible life insurance policy policy, is costlier than its term counterparts. Eligibility: Not everyone gets approved for whole life insurance as a result of extensive underwriting procedures that can omit those with specific health and wellness or lifestyle problems. Complexity and risk: The complex nature of IBC, coupled with its dangers, might deter many, specifically when less complex and much less dangerous options are readily available.

How does Infinite Banking Vs Traditional Banking create financial independence?

Designating around 10% of your monthly earnings to the policy is just not possible for most individuals. Part of what you check out below is just a reiteration of what has currently been claimed above.

Before you get yourself into a situation you're not prepared for, know the complying with first: Although the idea is typically offered as such, you're not actually taking a financing from on your own. If that held true, you wouldn't need to repay it. Instead, you're borrowing from the insurer and have to repay it with rate of interest.

Some social media articles advise utilizing cash value from entire life insurance to pay down bank card financial debt. The idea is that when you repay the funding with interest, the amount will be sent back to your investments. That's not just how it functions. When you repay the loan, a part of that rate of interest mosts likely to the insurance provider.

What happens if I stop using Whole Life For Infinite Banking?

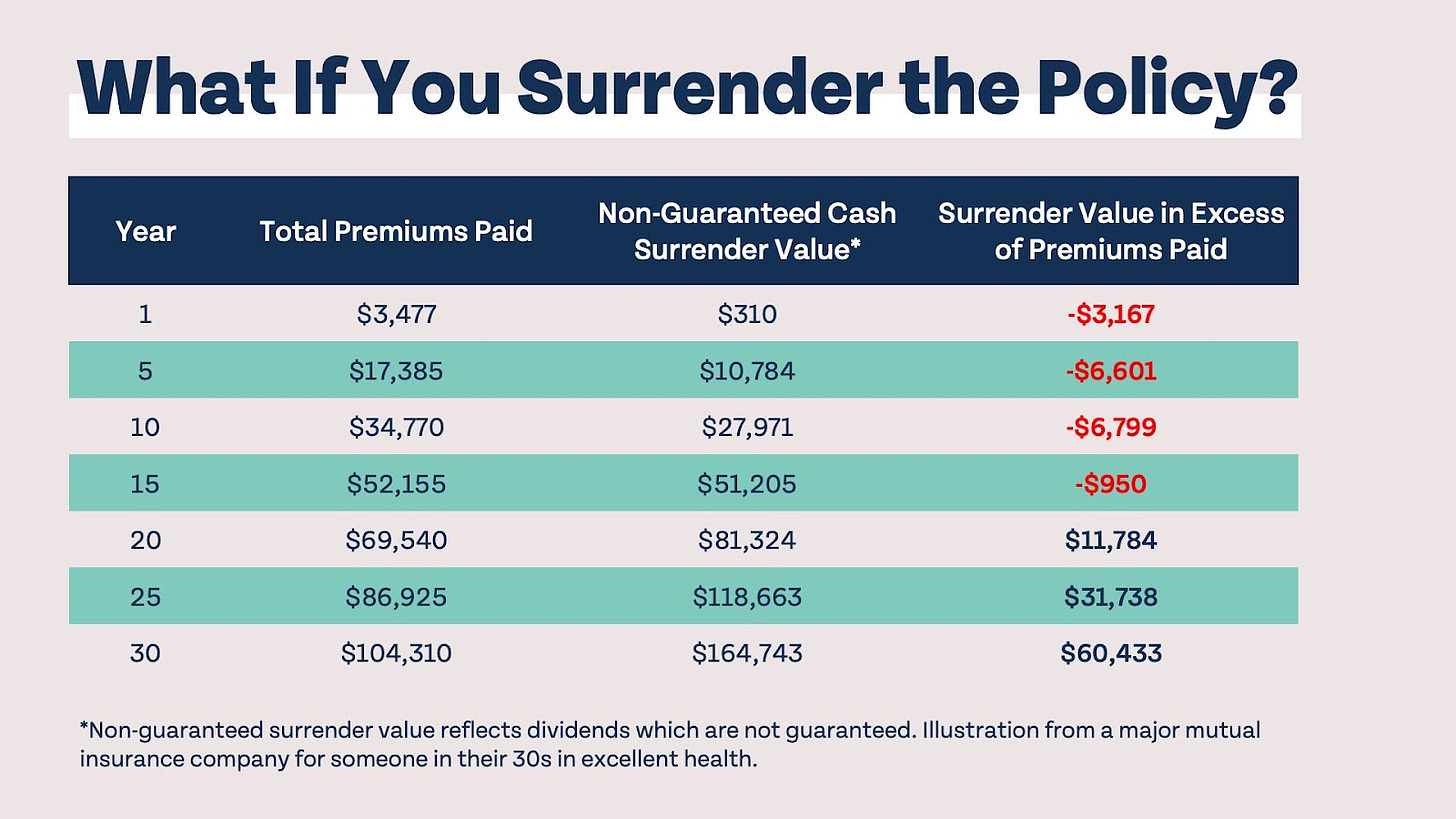

For the first a number of years, you'll be paying off the payment. This makes it incredibly difficult for your policy to build up worth during this time. Unless you can afford to pay a few to numerous hundred bucks for the next years or even more, IBC will not function for you.

Not every person must depend only on themselves for financial safety. Privatized banking system. If you call for life insurance policy, below are some valuable suggestions to think about: Consider term life insurance policy. These plans offer coverage throughout years with considerable financial obligations, like home loans, student lendings, or when looking after kids. See to it to search for the very best price.

What type of insurance policies work best with Infinite Banking For Retirement?

Visualize never ever having to fret about financial institution lendings or high passion rates again. That's the power of unlimited financial life insurance coverage.

There's no collection financing term, and you have the freedom to choose the settlement routine, which can be as leisurely as repaying the funding at the time of death. This adaptability includes the maintenance of the car loans, where you can go with interest-only repayments, maintaining the car loan balance flat and convenient.

How do I optimize my cash flow with Financial Leverage With Infinite Banking?

Holding cash in an IUL repaired account being attributed interest can commonly be much better than holding the cash on deposit at a bank.: You have actually constantly desired for opening your own bakeshop. You can obtain from your IUL policy to cover the first expenditures of renting out a room, buying equipment, and working with staff.

Personal finances can be obtained from typical financial institutions and credit history unions. Borrowing money on a credit score card is typically extremely pricey with yearly percentage rates of passion (APR) typically getting to 20% to 30% or more a year.

Latest Posts

Borrowing Against Whole Life Insurance

How To Set Up Infinite Banking

Life Insurance - Create Your Own Bank - Prevail